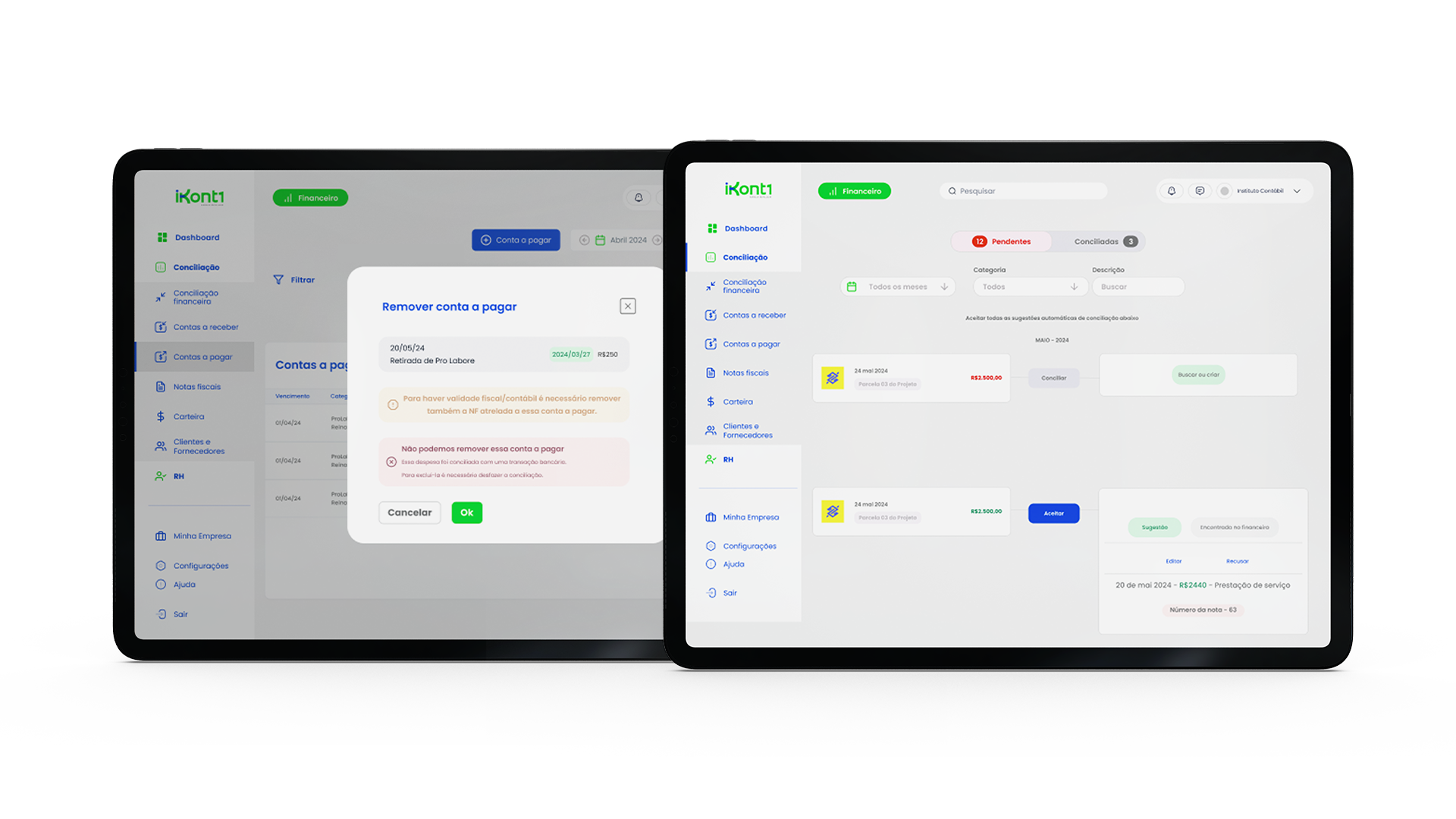

Design a complete bank integration and reconciliation solution for small and medium-sized businesses, ensuring clarity in account control, reliability in transactions, and agility in internal processes.

As a project in the presentation phase to potential customers, the main estimated gains were:

Reduction of manual errors in financial reconciliation.

Efficiency gains for administrative operators in small and medium-sized companies.

Product scalability to support new financial modules in the future.